I recently did an analysis of oil prices and the number of deepwater rigs in the US Gulf of Mexico going all the way back to 2014. I wasn’t sure what the results might indicate but I had a general idea of what the averages were at the end of each respective year.

In summary, here are the results in the US Gulf of Mexico from 2014 through 2021:

As the oil and gas industry was grinding trough the initial downturn that started at the end of 2014 and accelerated through 2015, the dramatic drop in oil prices did not result in an immediate corresponding reduction in floating deepwater rigs due to the long-term nature of many of the rig charters in place prior to and during 2014. However, by 2017, the floating rig count had been cut in half as compared to 2014. From 2017 through all of 2019, the count would average less than 20 rigs per year as oil prices fluctuated across that timeframe, sometimes at less than $60/bbl.

2020 proved to be the lowest in both average oil price and rig count which was entirely a result of the impact COVID-19 had on the global economy. Interestingly, 2021 was not a much better year for offshore rig activity as compared to 2020 in spite of the average oil price of $69/bbl. Though the global economy recovered significantly during 2021, and oil demand ramped back up as proved by the increase in prices, oil and gas companies took a very measured and cautious approach to deploying capital dollars in the US Gulf of Mexico. However, I predict this will be changing in the very near future.

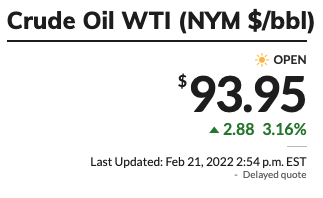

As of writing this piece, prices for WTI are above $90/bbl. Current tensions in Eastern Europe between Russia and Ukraine are likely inflating the current price but not significantly. What is worth noting is the market’s continued growth even as the world is attempting to transition to more renewable energy sources. The last time oil prices were this high there we over 40 rigs actively drilling in the US Gulf. While I do not think deepwater drilling counts will ever get back to the levels of 2014, I am confident that there is pent-up demand for more drilling and that rig counts will increase by meaningful amounts through this year and into next.

In order to achieve their ambitious energy transitions and net zero carbon goals, oil and gas companies must reap the benefits of the high oil prices today. In order to capitalize, they must drill more in the USGOM, a basin that is already primed to be a key resource.