JOO has recently participated in an RFI requested asking for indicative charter rates for new deepwater OSVs for oil field service work based on vessel construction costs. Prior to receiving pricing from our selected yards, I expected to see costs to build a new OSV at around $60 million USD. I was quite wrong, with the…

Recently, I’ve covered the aging fleet of Jones Act qualified deepwater OSVs operating in the US Gulf of Mexico and the implications it will have on the overall OSV market as demand continues to rise. In recent conversations about future vessel demands has focused on possible new build vessels. Given the cost of new construction…

Though the major international offshore oil and gas markets do not have a direct bearing on the US GOM, I do follow activity in those markets closely. Recent broker reports that cover other major regions have highlighted the aging fleet of OSVs and the lack of new OSVs contracted to be built to replace older…

The number of active drilling rigs continues to belie the overall activity in the deepwater US Gulf of Mexico. Historically, it has been deepwater floating rig activity that has driven vessel demand but the current deepwater rig count currently stands at 19. This is striking because the price of oil has remained sustained above $80…

Almost immediately after taking office in 2021, President Biden imposed a moratorium on federal oil and gas lease sales. Thirteen states in total, including Louisiana, Texas and all but one state along the Gulf Coast, filed suit. The suits claim substantial loss of revenues for local government funding, loss of jobs for those states’ workers, and…

From the recent peak in oil from $122/bbl on approximately June 8th to the price of $94/bbl on July 22nd, oil is down 22%. This is a rather dramatic change given the amount and short period of time. I recently discussed the potential of a recession and the impact it may have on oil demand and oil…

The deepwater floating rig count in the US Gulf of Mexico (GOM) is now currently at 19 rigs. This is a small upward trend that I suspect will remain sustained, especially when the known additional deepwater rigs coming to the market actually arrive. Though the new count only represents a one rig increase this year, it is meaningful for the…

As the OSV market continues to remain tight into foreseeable future, charterers of OSVs in our industry are scrambling to figure out how to meet their increasing vessel needs. Many industry observers point to a reactivation of the remaining stacked fleet as a means to bring additional supply to the market. When considering the only truly…

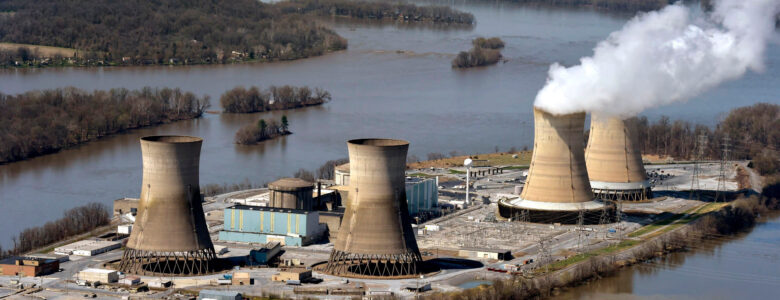

The nuclear power generation industry is rarely front and center in the global energy transition discussion. Most of the focus has been placed on the need to develop alternative energy sources such as wind and solar, with the objectives to reduce oil and gas consumption and achieve net zero carbon emissions. This is certainly a…

In early 2020, prior to the the COVID shutdowns in mid-March, the offshore oil and gas industry in the US GOM was showing strong signs of a sustained recovery. By the end of February 2020, there were 22 deep water rigs actively drilling, the most since 2017. After the pandemic shut the world down, offshore activity dropped dramatically…